georgia property tax relief for seniors

Retirees in Georgia can apply for a property tax exemption or a property tax deferral Hawaii Seniors aged 65 and older in Honolulu can be exempt from paying 120000 of their home value. It was founded in 2000 and has been an active part of the.

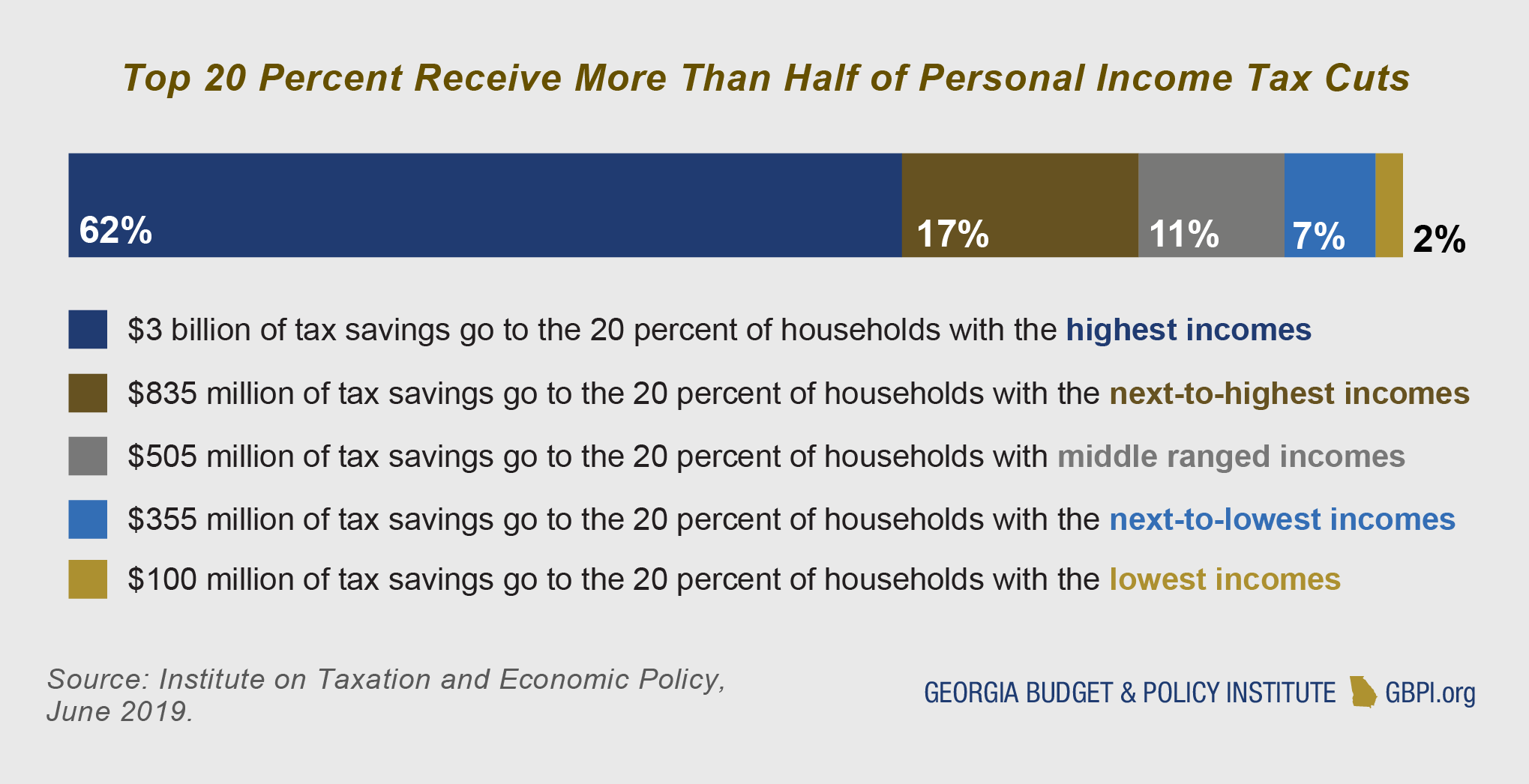

The Tax Cuts And Jobs Act In Georgia High Income Households Receive Greatest Benefits Georgia Budget And Policy Institute

Georgia Property Tax Relief Incorporated is a consulting firm that is dedicated to reducing the property tax liabilities and burdens of Georgia property owners.

. About the Company Georgia Seniors Relief Of School Tax. Seniors over 65 with an annual income of less than 30000 can. Office of Communications 404-651-7774.

New Yorks senior exemption is also pretty generous. Does Georgia offer any income tax relief for retirees. Take Advantage of All Applicable Tax Breaks Standard Homestead Exemption From Georgia Property Tax.

There are several property tax exemptions in Georgia and most. Property Tax Returns and Payment. Georgia Property Tax Advantages Benefits Deductions and Exemptions for Seniors 65 and Older Homestead Exemption.

Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days. CuraDebt is a company that provides debt relief from Hollywood Florida. Wednesday May 12 2010.

To be granted a property tax exemption in Georgia you have to be the owner of the property from January 1 of that taxable year. Up to 25 cash back Method 2. The Georgia Department of Revenue has provided relief as specified in the below FAQs and Press Releases.

Property Taxes in Georgia. If you meet the eligibility criteria exemptions of up to 50000 off the assessed value of your property may be available. Tax Benefits in Georgia.

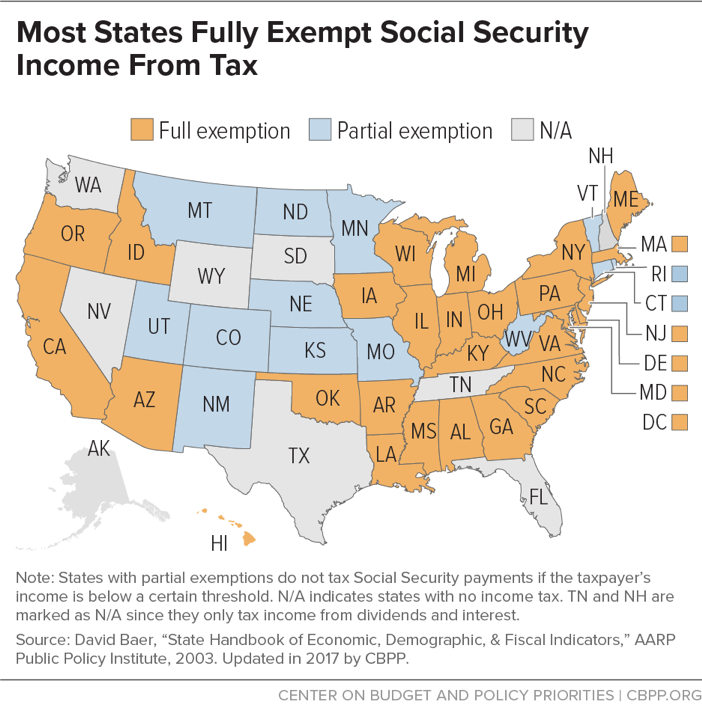

Residents of Georgia aged 62 years and older are exempt from its 6 tax all social security and 70000 per a couple of income on pensions interest dividends and. It was founded in 2000 and has since become a part of the. A retirement exclusion is allowed provided the taxpayer is 62 years of age or older or the taxpayer is totally and permanently.

Generally a homeowner is entitled to a homestead exemption on their. ATLANTA Governor Sonny Perdue today announced that he has signed House Bill 1055 a bill. Property Tax Homestead Exemptions.

The home of each Georgia resident that is. Our staff has a proven record. Additionally there are a number of exemptions that can help seniors in need of property tax relief.

About the Company Georgia Property Tax Relief For Seniors CuraDebt is a company that provides debt relief from Hollywood Florida. Coronavirus Tax Relief FAQs. County Property Tax Facts.

The tax for recording the. Press Releases For more information about the COVID. Its calculated at 50 percent of your homes appraised value meaning youre only paying half the usual taxes for your.

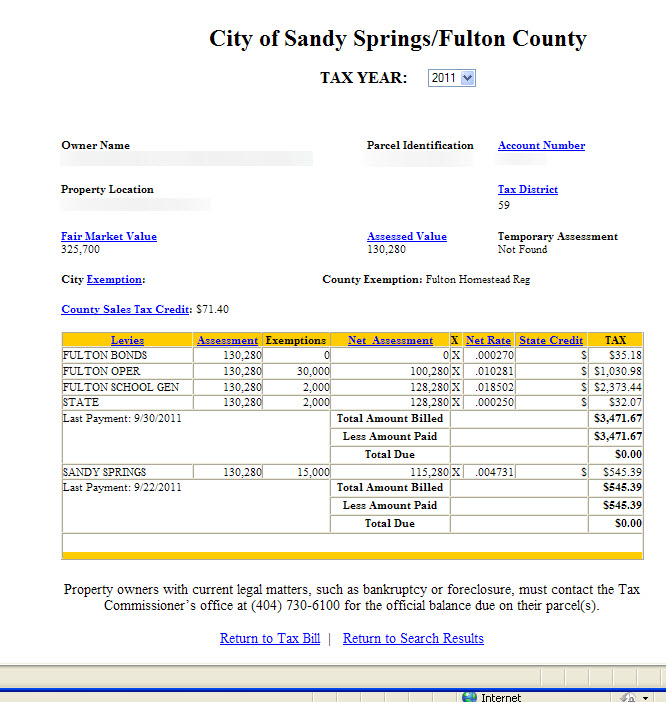

Del Webb Chateau Elan The Senior School Tax Exemption L5A provides a 100 exemption from taxes levied by the Gwinnett County Board of Education on your home and up. What is the Georgia homestead exemption. The Georgia homestead exemption is available to.

Property Tax Relief For Income Qualified Homeowners Local Housing Solutions

Georgia S Kemp Seeks Tax Breaks Rebutting Abrams On Economy Wabe

Georgia Tax Refund Checks Property Tax Break What To Know 11alive Com

Georgia Retirement Tax Friendliness Smartasset

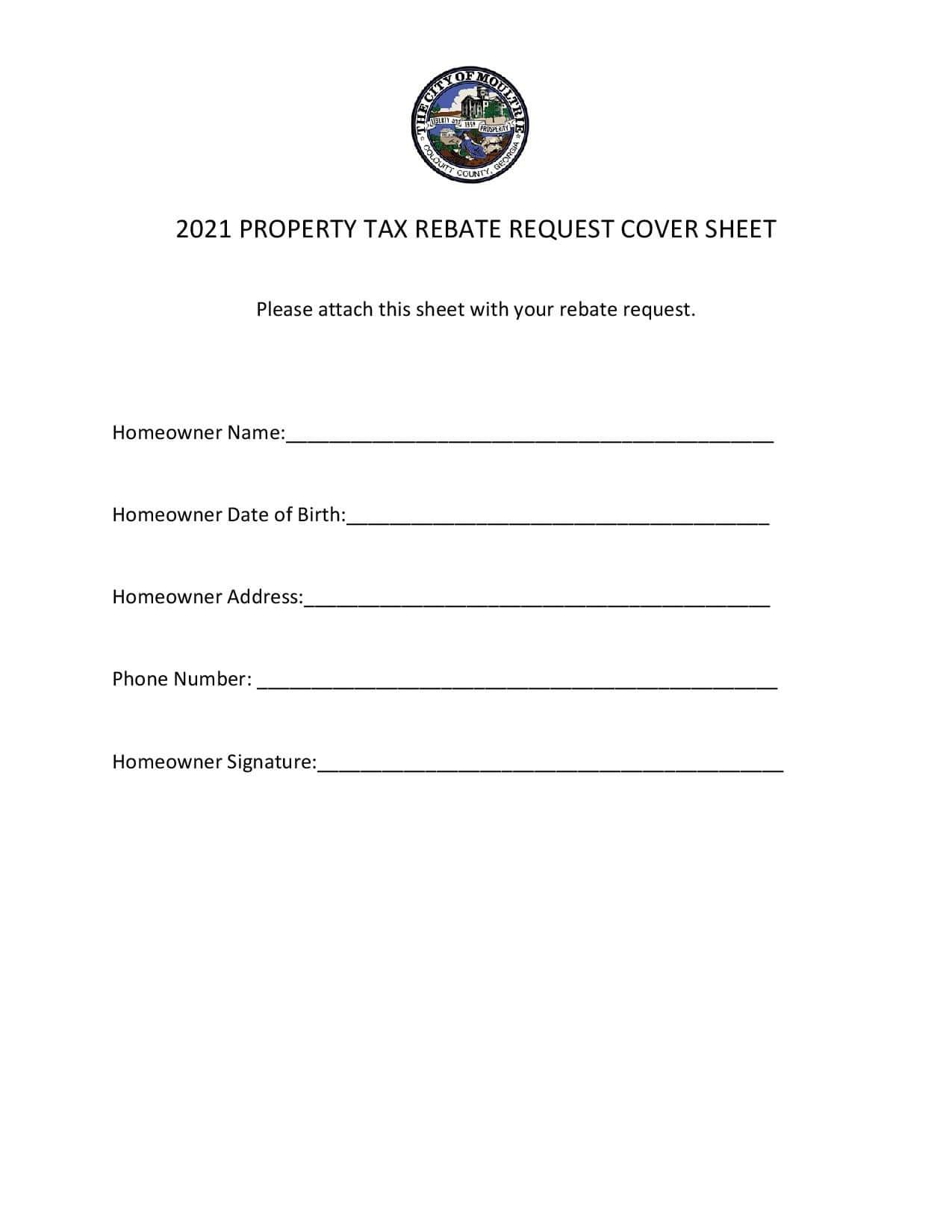

City Of Moultrie Moultrie City Council Votes To Offer A Rebate To Elderly Homeowners

Tax Assessor Information For Residents Walton County Ga

The Tax Cuts And Jobs Act In Georgia High Income Households Receive Greatest Benefits Georgia Budget And Policy Institute

Georgia Homestead Exemption Reminder Brian M Douglas

2022 State Tax Reform State Tax Relief Rebate Checks

Find Tax Help Cuyahoga County Department Of Consumer Affairs

5 Property Tax Deductions In Georgia For You Excalibur

Choosing An Exemption Richmond County Tax Commissioners Ga

Topic Property Tax Elimination Change Org

Sandy Springs Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Many Metro Atlanta Counties Offer Big Tax Breaks For Seniors 2020

2019 Income Limit Set For Gwinnett Senior Property Tax Exemption

Homestead Exemptions Georgia 2019 Cut Your Property Tax Bill Youtube